In einer Welt, in der Inflation Bargeldreserven aufzehrt und wirtschaftliche Unsicherheit zur Norm w...

In einer Welt, in der Inflation Bargeldreserven aufzehrt und wirtschaftliche Unsicherheit zur Norm w...

.webp)

Introduction: In a recent fireside chat hosted by Bernstein, Michael Saylor, co-founder and Executiv...

In a world where inflation is chipping away at cash reserves and economic uncertainty is the norm, h...

This assumption is based on several theoretical and practical points. 1. Limitation on Money Printin...

We’ve been brainwashed to believe that growth is everything. More is always better. But this idea of...

In einer Welt, in der Inflation Bargeldreserven aufzehrt und wirtschaftliche Unsicherheit zur Norm wird, ist das Halten von Bitcoin in der Unternehmensbilanz mehr als nur eine Absicherung – es ist ein Game-Changer. Weit entfernt davon, ein „spekulativer Vermögenswert“ zu sein, hat Bitcoin Resilienz, beeindruckende Renditen und ein einzigartiges Wertversprechen gezeigt, das viele Unternehmen immer noch zögerlich annehmen. Hier wird erklärt, warum jedes Unternehmen Bitcoin halten sollte und wie es als Lebensader zur Ent-Zombifizierung dienen kann – für frische Energie, Wachstumspotenzial und zukunftssichere Finanzstärke.

Warum Bitcoin auf der Unternehmensbilanz gehört

Performance-Vergleich:

Bitcoin hat traditionelle Vermögenswerte, einschließlich großer Indizes wie dem S&P 500, kontinuierlich übertroffen. In den letzten 10 Jahren betrug die durchschnittliche Jahresrendite von Bitcoin etwa 230 %, im Vergleich zu etwa 10 % beim S&P 500.

Selbst in schwierigen Jahren erholte sich Bitcoin mit beispielloser Stärke und übertraf Anleihen, Gold und Aktien.

Von 2020 bis 2021 stieg Bitcoin von etwa 7.000 USD im Januar 2020 auf fast 69.000 USD im November 2021 und steigerte damit die Bilanzen der BTC-haltenden Unternehmen erheblich.

MicroStrategy: Die Bitcoin-Strategie als Vorbild

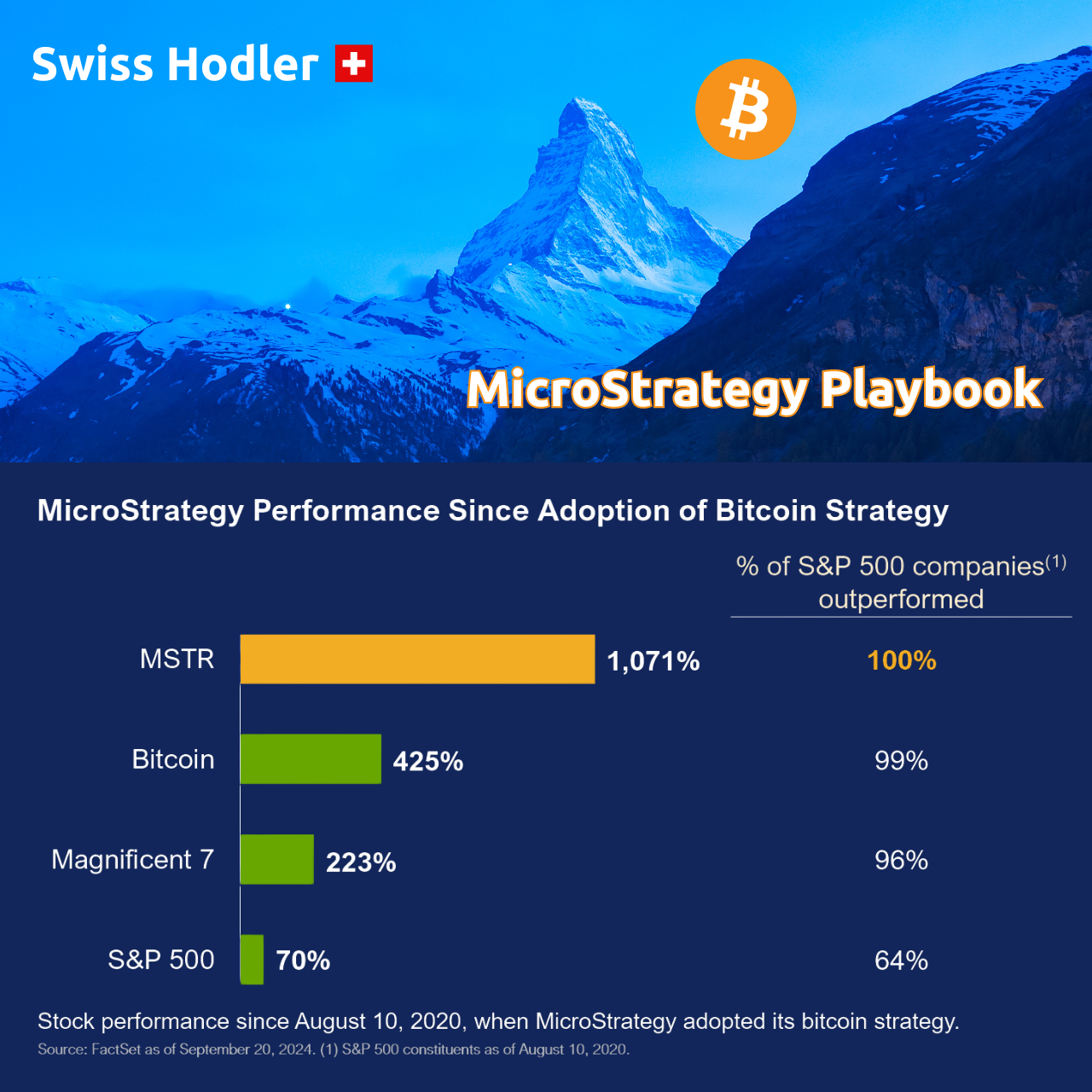

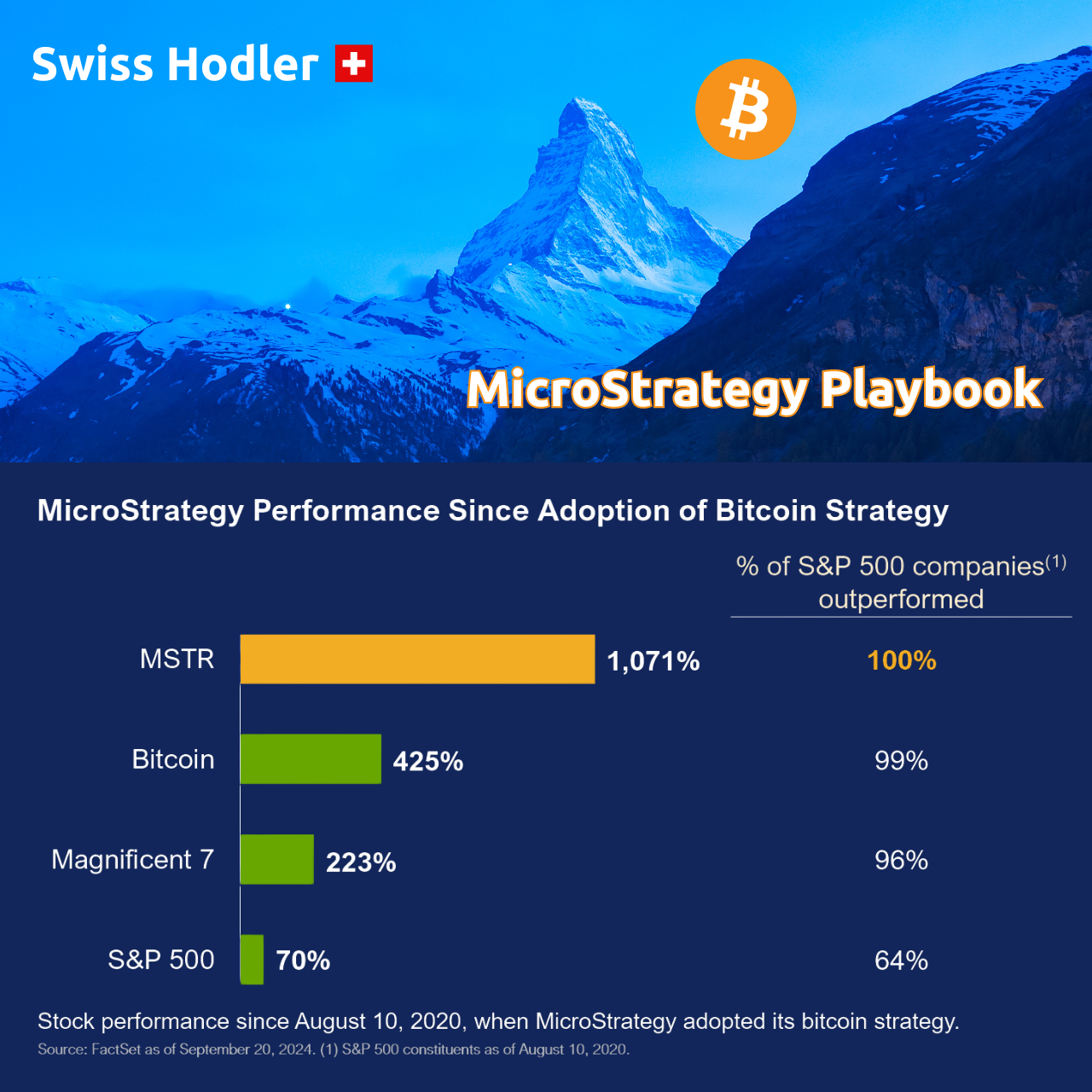

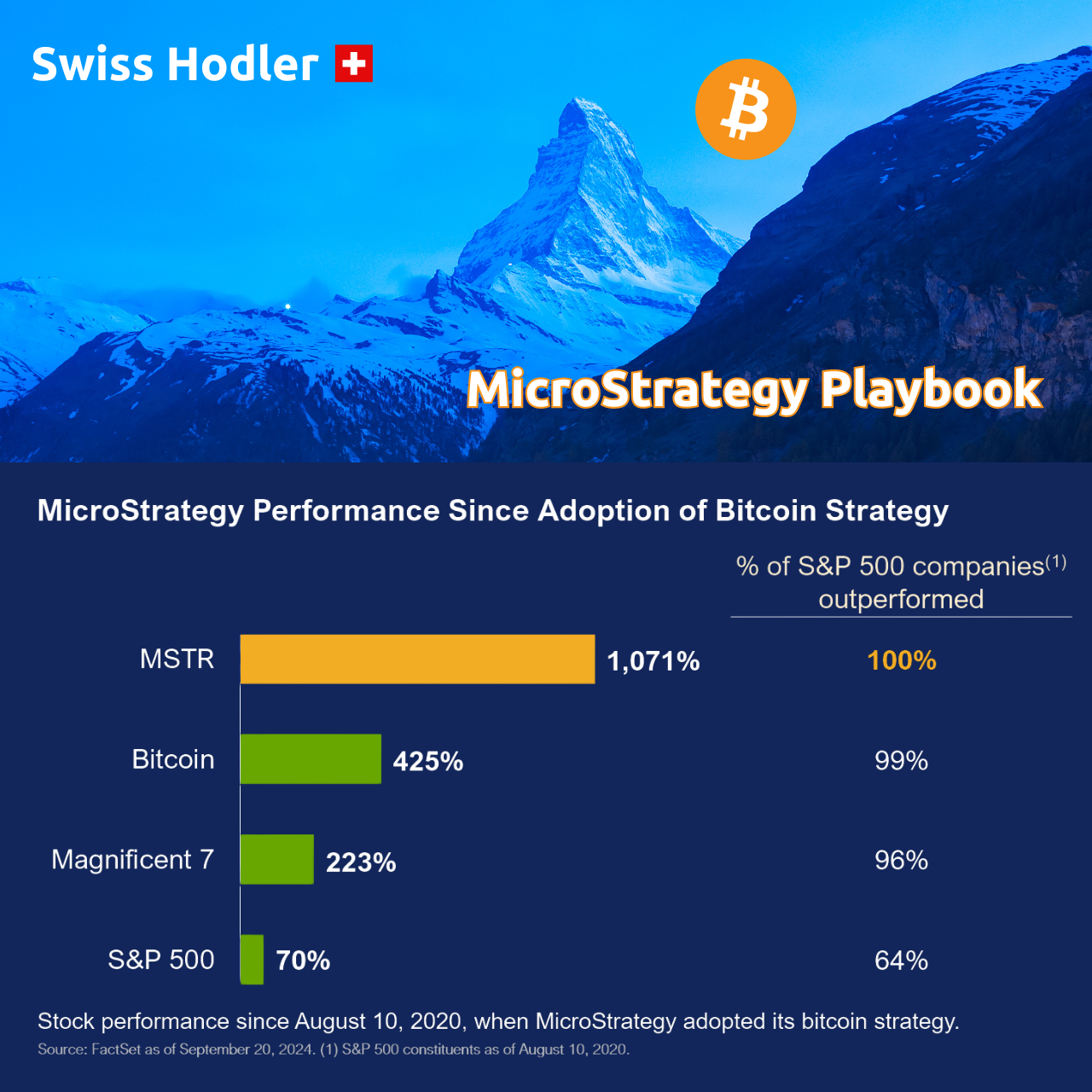

MicroStrategy (MSTR) unter der Führung von Michael Saylor ist ein herausragendes Beispiel dafür, wie Bitcoin die finanzielle Landschaft eines Unternehmens verändern kann. Durch die Umwandlung seiner Bargeldreserven in Bitcoin hat MicroStrategy sowohl den S&P 500 als auch seine eigenen Geschäftskennzahlen übertroffen:

Aktienentwicklung: Der Aktienkurs stieg von rund 120 USD auf über 500 % während des Bitcoin-Bullenmarktes.

Werterhalt: Die Strategie dient nicht nur der Spekulation, sondern dem Werterhalt in einem inflationsgeplagten Umfeld.

Bargeldreserven als totes Gewicht: In einem inflationären Umfeld verlieren Bargeldreserven jährlich an Wert. Bitcoin bietet eine Möglichkeit, diese Reserven gewinnbringend einzusetzen:

Kaufkraft-Erhalt: Dank der fixen Menge von 21 Millionen Coins bleibt Bitcoin resistent gegen Inflation.

Finanzielle Resilienz: Unternehmen mit Bitcoin-Reserven sind besser gerüstet, wirtschaftliche Stürme zu überstehen.

Talente anziehen: Bitcoin-Savvy-Talente bevorzugen innovative Unternehmen mit zukunftsweisenden Strategien.

Liquidität und Flexibilität: Bitcoins Markt ist global zugänglich und operiert rund um die Uhr.

Bitcoin vs. Zombie-Unternehmen

Zombie-Unternehmen kämpfen mit Schulden und stagnierendem Wachstum. Bitcoin kann diesen Kreislauf durchbrechen, indem es als höher rentierender Vermögenswert Flexibilität und Stärke in die Bilanz einbringt.

Schlüsselstatistiken:

Maximales Angebot: 21 Millionen Coins sorgen für eingebaute Knappheit.

Institutionelles Interesse: Immer mehr Großunternehmen erkennen Bitcoins Potenzial.

Hedge gegen den S&P 500: Bitcoin übertraf in den letzten zehn Jahren regelmäßig die Renditen des S&P 500.

Vorbereitung auf einen neuen Standard

Bitcoin auf der Bilanz ist mehr als ein Trend – es ist der Weg zu Widerstandsfähigkeit, Dezentralisierung und proaktivem Finanzmanagement. Unternehmen, die jetzt handeln, sichern sich einen Wettbewerbsvorteil und sind bereit für die Zukunft des globalen Finanzwesens.

Fazit: Bitcoin bietet Unternehmen die Energie, Flexibilität und das Wachstumspotenzial, um Stagnation zu entkommen und ihre Finanzen zukunftssicher zu gestalten. Es ist Zeit, Bitcoin nicht nur als Absicherung, sondern als wesentlichen Bestandteil einer klugen Unternehmensstrategie zu betrachten.

Relai Business richtet sich an kleine und mittelständische Unternehmen, die Bitcoin in ihre Bilanz aufnehmen möchten – mit exklusivem persönlichem Service und fachkundiger Beratung.

Tags: Bitcoin, Growth, Bitcoin Standard

Introduction:

In a recent fireside chat hosted by Bernstein, Michael Saylor, co-founder and Executive Chairman of MicroStrategy, discussed his Bitcoin investment thesis and how his company transformed by adopting Bitcoin as its primary treasury reserve asset. Moderated by Gautam Chhugani of Bernstein, the conversation covered the rationale behind MicroStrategy's bold Bitcoin strategy, its impact on the company, and the broader implications for investors and businesses.

MicroStrategy’s Journey to Bitcoin:

Founded in 1989, MicroStrategy was a low-growth enterprise software company by 2020, with stagnant business prospects and $500 million in cash. Faced with the choice of risky acquisitions, share buybacks, or holding cash with 0% interest, Saylor opted to take a risk on Bitcoin. He viewed Bitcoin as a transformational monetary network, likening it to investing in tech giants like Google or Amazon before mainstream recognition. Since adopting Bitcoin, MicroStrategy has built one of the largest Bitcoin balance sheets, positioning itself as a pioneer in digital capital strategy.

Bitcoin as the Superior Asset:

Saylor described Bitcoin as "digital gold," perfect money, and a unique diversifier that outperforms all other asset classes. With a compound annual growth rate (CAGR) of 49% over the past four years, Bitcoin has consistently outperformed traditional investments, including the S&P 500, real estate, and gold. He emphasized that Bitcoin is a 1,000-year asset, capable of preserving value without counterparty risks associated with physical and financial assets. Unlike traditional capital, Bitcoin is durable, scarce, and immune to inflationary pressures, making it the ultimate store of value.

The Investor Dilemma:

Most returns in the S&P 500 come from a small number of tech monopolies. Traditional portfolios are struggling to keep up with inflation rates, and conventional investments are not delivering desired returns. Saylor posits that Bitcoin offers a solution to this investor dilemma, providing superior performance in both the short and long term. MicroStrategy’s approach has been to leverage this by buying Bitcoin, securing cheap capital, and transforming it into high-yield digital assets.

MicroStrategy's Arbitrage Strategy:

MicroStrategy has raised over $10 billion to acquire Bitcoin, achieving significant returns through smart capital structuring. By borrowing at low interest rates and investing in Bitcoin, the company has capitalized on arbitrage opportunities, outperforming all 500 companies in the S&P 500. Their strategy involves issuing convertible debt, equity, and other financial instruments backed by Bitcoin, allowing them to outperform the market while minimizing downside risks.

Volatility as a Feature, Not a Bug:

Addressing the concern of Bitcoin's volatility, Saylor explained that volatility is not a flaw but a feature that attracts traders, investors, and financiers seeking better returns. Volatility provides the liquidity and opportunities for financial products like derivatives, which help generate superior yields and improve the capital structure of companies that adopt Bitcoin. According to Saylor, the risks associated with Bitcoin are outweighed by its potential as a powerful deflationary asset.

The Future of Bitcoin Adoption:

The chat concluded with insights into the future of Bitcoin as an asset class. Saylor believes that institutional adoption is accelerating, driven by the launch of Bitcoin ETFs, regulatory acceptance, and Bitcoin's integration with traditional finance. As more companies adopt Bitcoin as a treasury reserve asset, demand will drive prices higher, making Bitcoin a necessary part of any long-term investment strategy.

Key Takeaways:

Michael Saylor's discussion reveals that Bitcoin is more than just an asset—it's a revolutionary financial technology that transforms how businesses think about capital preservation and growth. With its unique qualities as digital property, Bitcoin offers a sustainable way for companies to protect and grow their wealth in a world of increasing financial uncertainty. MicroStrategy's strategy serves as a blueprint for leveraging Bitcoin to create long-term value in the digital age.

Ready for a Bitcoin Standard?

Relai Business is for small to medium-sized businesses who want to add Bitcoin to their balance sheets with exclusive personal service and expert guidance.

.webp?width=1200&height=675&name=michael-saylor-sees-bitcoin-surging-to-13-million-by-2045%20(1).webp)

Tags: Bitcoin, Growth, Bitcoin Standard, Bitcoin Strategy for Businesses, MicroStrategy Playbook

In a world where inflation is chipping away at cash reserves and economic uncertainty is the norm, holding Bitcoin on a company balance sheet is more than just a hedge—it’s a game-changer. Far from being a “speculative asset,” Bitcoin has shown resilience, impressive returns, and a unique value proposition that many companies are still slow to embrace. Let’s break down why every company should hold Bitcoin on its balance sheet and how this can be a lifeline to unzombify any business, giving it fresh energy, growth potential, and future-proof financial strength.

Bitcoin has consistently outperformed traditional assets, including major indexes like the S&P 500. Here’s a quick look at Bitcoin’s performance compared to the S&P 500 over recent years:

MicroStrategy (MSTR), under the leadership of Michael Saylor, is perhaps the most notable example of how Bitcoin can transform a company’s financial landscape. By converting its cash reserves to Bitcoin, MicroStrategy has outperformed the S&P 500 and even its own business metrics, largely due to Bitcoin's appreciation.

Since beginning its Bitcoin acquisitions in August 2020, MicroStrategy’s stock has skyrocketed:

Corporate cash reserves sitting idly on a balance sheet are dead weight, especially in an inflationary environment where cash loses value every year. Holding Bitcoin allows a company to put its reserves to work, giving businesses a new way to grow assets.

Preservation of Purchasing Power: With fiat currencies losing purchasing power through inflation, Bitcoin acts as a hedge. Unlike cash, Bitcoin’s fixed supply and scarcity help it hold value and resist inflation.

Financial Resilience: During economic downturns, companies with Bitcoin reserves are better positioned to weather financial storms. By securing a portion of assets in Bitcoin, businesses can diversify risk and have a reliable store of value.

Attracting Modern Talent: More employees, especially in the tech sector, are Bitcoin-savvy and prefer working for forward-thinking companies. Holding Bitcoin on the balance sheet signals innovation and commitment to future-proofing—a quality that resonates with top talent.

Liquidity and Flexibility: Bitcoin’s market is globally accessible and operates 24/7. Unlike other assets that may require banks and intermediaries to liquidate, Bitcoin provides instant liquidity, offering companies unprecedented financial flexibility.

“Zombie companies” refer to businesses that are barely scraping by, weighed down by debt and stagnant growth. These companies are often unable to keep up with inflation and are locked in a cycle of low profitability. Bitcoin’s value growth has the power to “unzombify” these businesses by injecting a higher-yield asset into their portfolios and potentially increasing their balance sheet’s strength and flexibility. Companies that adopt Bitcoin can transition from a survival-focused model to one primed for growth and long-term viability.

Bitcoin on the balance sheet is more than a trend; it’s a shift toward a new corporate standard that values resilience, decentralization, and proactive financial management. Companies that act now stand to gain the competitive edge as the world transitions toward digital and decentralized finance. Those who don’t risk being left behind, stuck in old financial paradigms.

To thrive in a changing economy, companies need more than traditional assets and cash reserves. Bitcoin is the tool that will give businesses the energy, flexibility, and growth potential they need to escape stagnation, future-proof their finances, and join the revolution in global finance. It’s time to consider Bitcoin—not just as a hedge, but as a core part of a smart, forward-thinking corporate strategy.

Relai Business is for small to medium-sized businesses who want to add Bitcoin to their balance sheets with exclusive personal service and expert guidance.

Tags: Bitcoin, Growth, Bitcoin Standard

This assumption is based on several theoretical and practical points.

1. Limitation on Money Printing

Fiat Standard:

Governments can print money to fund wars without immediate fiscal constraints. This ability to create money out of thin air has historically enabled extensive military spending.

Bitcoin Standard:

Bitcoin's fixed supply (21 million coins) prevents arbitrary money creation. Governments would need to fund wars through taxation or borrowing, making the costs of war more transparent and potentially less politically feasible.

2. Economic Restraint

Fiat Standard:

The ability to print money can lead to reckless spending, including on military engagements. The lack of immediate financial repercussions makes it easier for governments to engage in prolonged conflicts.

Bitcoin Standard:

With limited monetary expansion, governments would face greater economic restraint. The immediate impact on national finances could act as a deterrent to unnecessary or prolonged military engagements.

3. Public Accountability

Fiat Standard:

Central banks and governments can obscure the true cost of war through inflation and debt accumulation, which the general public does not (immediately) perceive.

Bitcoin Standard:

The need to raise funds through direct taxation or borrowing would make the costs of war more visible to the public, (potentially) increasing resistance to unnecessary conflicts.

4. International Trade and Peace

Fiat Standard:

Currency manipulation and competitive devaluations can lead to economic tensions between countries, escalating into military conflicts.

Bitcoin Standard:

A neutral, global currency like Bitcoin could reduce these economic tensions, promoting stability and cooperation.

Tags: Bitcoin, Growth, Marketing, Bitfluencers

We’ve been brainwashed to believe that growth is everything. More is always better. But this idea of endless growth? It’s a product of the fiat monetary system. In a world where money loses value as we speak ("thanks to" central banks printing money out of thin air), growth isn’t just encouraged - it’s necessary to keep up with the ever-growing inflation. It’s like running on a treadmill that keeps speeding up. If you don’t grow, you fall behind. 😵

But what if the money wasn’t broken? What if your wealth held its value over time? In that world, the constant pressure to grow wouldn’t exist. You wouldn’t need to chase after more and more just to maintain your standard of living. The pursuit of endless growth is a byproduct of the flawed fiat system - a system designed to keep us working harder for less, and to make us poorer and poorer.

BUT WHY IS MARKETING NECESSARY?

We're not saying all growth is bad. Take marketing, for example. It’s often seen as part of the problem, pushing us to buy more, consume more. You know the quote, "We buy things we don't need with money we don't have to impress people we don't like."

When it comes to Bitcoin, marketing is crucial. It’s not about selling more stuff we don’t need - it’s about spreading the word, orange-pilling people to understand what Bitcoin is and how it can fix the world.

Without marketing, the message of Bitcoin would stay stuck in a small corner of the internet. Marketing helps bring it to the masses, showing normies that there’s a viable alternative to the broken fiat system.

It’s not about pushing more consumption - it’s about education and awareness, and spreading a message of financial freedom 🧡

How Bitfluencers Can Help?

At Bitfluencers, we amplify this message by helping Bitcoin companies spread the orange word and boost adoption.

With our authentic and engaging content, we bring Bitcoin’s revolutionary ideas to the forefront, making sure the world knows there's a better alternative to the fiat treadmill.

Contact THE Bitcoin Marketing Team for collaboration 🤝

Tags: Bitcoin, Growth, Marketing, Bitfluencers