The Problem: Money is Broken Let’s start with a fact: the current financial system isn’t working for...

The Problem: Money is Broken Let’s start with a fact: the current financial system isn’t working for...

In einer Welt, in der Inflation Bargeldreserven aufzehrt und wirtschaftliche Unsicherheit zur Norm w...

Bitcoin 101: Verstehe Bitcoin, wie es funktioniert und warum jeder diese digitale Währung für finanz...

.webp)

Introduction: In a recent fireside chat hosted by Bernstein, Michael Saylor, co-founder and Executiv...

Bitcoin has been making headlines for years, but for those just getting started, it can seem complex...

In a world where inflation is chipping away at cash reserves and economic uncertainty is the norm, h...

The Belle Époque was the real deal - back when people were actually building stuff that mattered. Re...

Let’s start with a fact: the current financial system isn’t working for most of us. Inflation is eating away your savings every single year. What cost $1,000 a decade ago might cost $2,000 or more today. Why? Because central banks keep printing money, increasing the supply of currency and lowering its value.

Your money buys you less and less. This isn’t accidental—it’s built into the system. As more money floods the market, the purchasing power of each dollar, euro, or franc declines. Over time, this forces people to seek assets like real estate. Houses become investments, not homes, because holding cash means losing value. The result? Skyrocketing home prices and a widening gap between those who own assets and those who don’t.

The root of the problem? A monetary system controlled by a few institutions that can change the rules whenever they want. Your financial future is at the mercy of decisions you have no say in.

Bitcoin offers a way out. Unlike traditional currencies, Bitcoin isn’t controlled by governments, central banks, or corporations. It’s decentralized—a global network run by volunteers who are incentivized to keep the system secure and operational. No CEOs. No employees. No headquarters.

But what makes Bitcoin truly revolutionary?

Limited Supply: There will only ever be 21 million bitcoins. No more. This built-in scarcity means Bitcoin cannot be inflated like fiat currencies.

Supply Halving: Every four years, the amount of new Bitcoin entering circulation is cut in half. This ensures that Bitcoin becomes more scarce over time, strengthening its ability to hold value.

Incentive-Based Security: The Bitcoin network runs because people all over the world are rewarded (with Bitcoin itself) for securing it. This creates a robust, tamper-proof system that no single entity can control.

Global and Permissionless: Anyone with an internet connection can use Bitcoin. No bank accounts, credit checks, or approvals needed. It’s money that works the same for everyone, everywhere.

Bitcoin is the first truly decentralized form of money. It represents freedom, fairness, and financial sovereignty in a way no fiat currency ever could.

Imagine a financial world where the base layer—what everything else is built on—is stable, predictable, and not subject to manipulation. That’s Bitcoin. Just as the internet became the base layer for global communication, Bitcoin is poised to become the base layer for global money.

With a fixed supply and a secure, decentralized network, Bitcoin provides a foundation on which future financial systems can be built. It offers:

Stability Over Time: While short-term price swings happen, Bitcoin’s long-term trajectory shows resilience and growth.

True Ownership: You control your money, not a bank. No one can freeze, seize, or debase your Bitcoin.

Borderless Transactions: Send money anywhere, anytime, without intermediaries or restrictions.

Bitcoin flips the script. It gives power back to individuals, offering a monetary system that serves the people—not the powerful.

Let’s end with a real-world example: the price of iPhones in Bitcoin over the years. Despite fluctuations, one thing stands out—Bitcoin’s purchasing power is increasing over time.

iPhone 4 (2010): Priced at $599 (~1,000 BTC at the time)

iPhone 6 (2014): Priced at $699 (~2 BTC at the time)

iPhone X (2017): Priced at $999 (~0.1 BTC at the time)

iPhone 15 (2023): Priced at $1,199 (~0.03 BTC at the time)

What does this mean? While the dollar price of an iPhone has increased, the amount of Bitcoin needed to buy one has dropped dramatically. If you held Bitcoin instead of dollars, your purchasing power would have grown significantly.

The current financial system is designed to make you lose. Inflation, manipulated currencies, and declining purchasing power keep you running on a treadmill. Bitcoin stops the treadmill. With its fixed supply, decentralized control, and global accessibility, Bitcoin is set to become the base layer of a new, fairer financial system.

The earlier you understand this shift, the better prepared you’ll be for the future. Bitcoin isn’t just digital money—it’s a monetary revolution. The question is: will you be part of it?

Tags: Bitcoin, Bitcoin Standard

In einer Welt, in der Inflation Bargeldreserven aufzehrt und wirtschaftliche Unsicherheit zur Norm wird, ist das Halten von Bitcoin in der Unternehmensbilanz mehr als nur eine Absicherung – es ist ein Game-Changer. Weit entfernt davon, ein „spekulativer Vermögenswert“ zu sein, hat Bitcoin Resilienz, beeindruckende Renditen und ein einzigartiges Wertversprechen gezeigt, das viele Unternehmen immer noch zögerlich annehmen. Hier wird erklärt, warum jedes Unternehmen Bitcoin halten sollte und wie es als Lebensader zur Ent-Zombifizierung dienen kann – für frische Energie, Wachstumspotenzial und zukunftssichere Finanzstärke.

Warum Bitcoin auf der Unternehmensbilanz gehört

Performance-Vergleich:

Bitcoin hat traditionelle Vermögenswerte, einschließlich großer Indizes wie dem S&P 500, kontinuierlich übertroffen. In den letzten 10 Jahren betrug die durchschnittliche Jahresrendite von Bitcoin etwa 230 %, im Vergleich zu etwa 10 % beim S&P 500.

Selbst in schwierigen Jahren erholte sich Bitcoin mit beispielloser Stärke und übertraf Anleihen, Gold und Aktien.

Von 2020 bis 2021 stieg Bitcoin von etwa 7.000 USD im Januar 2020 auf fast 69.000 USD im November 2021 und steigerte damit die Bilanzen der BTC-haltenden Unternehmen erheblich.

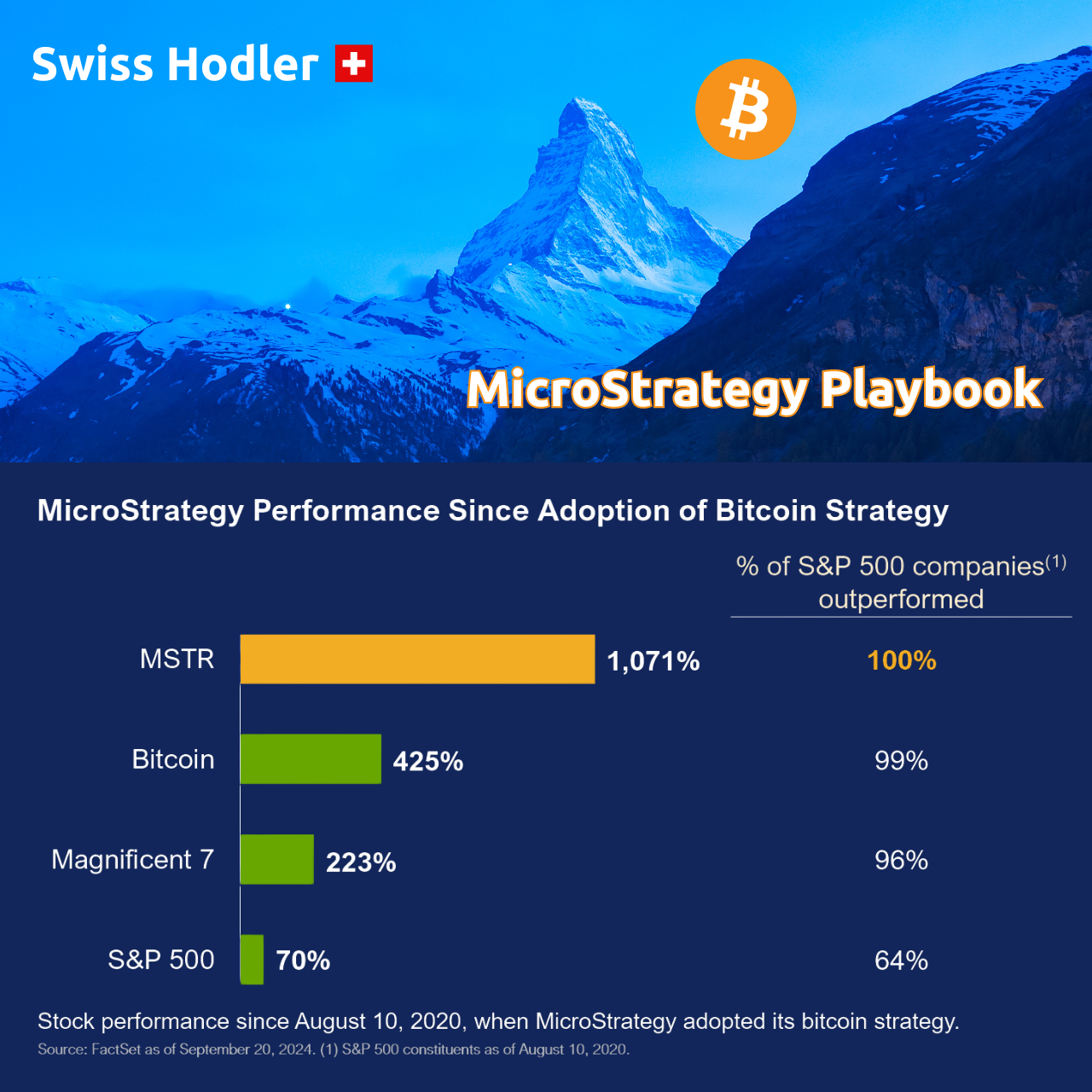

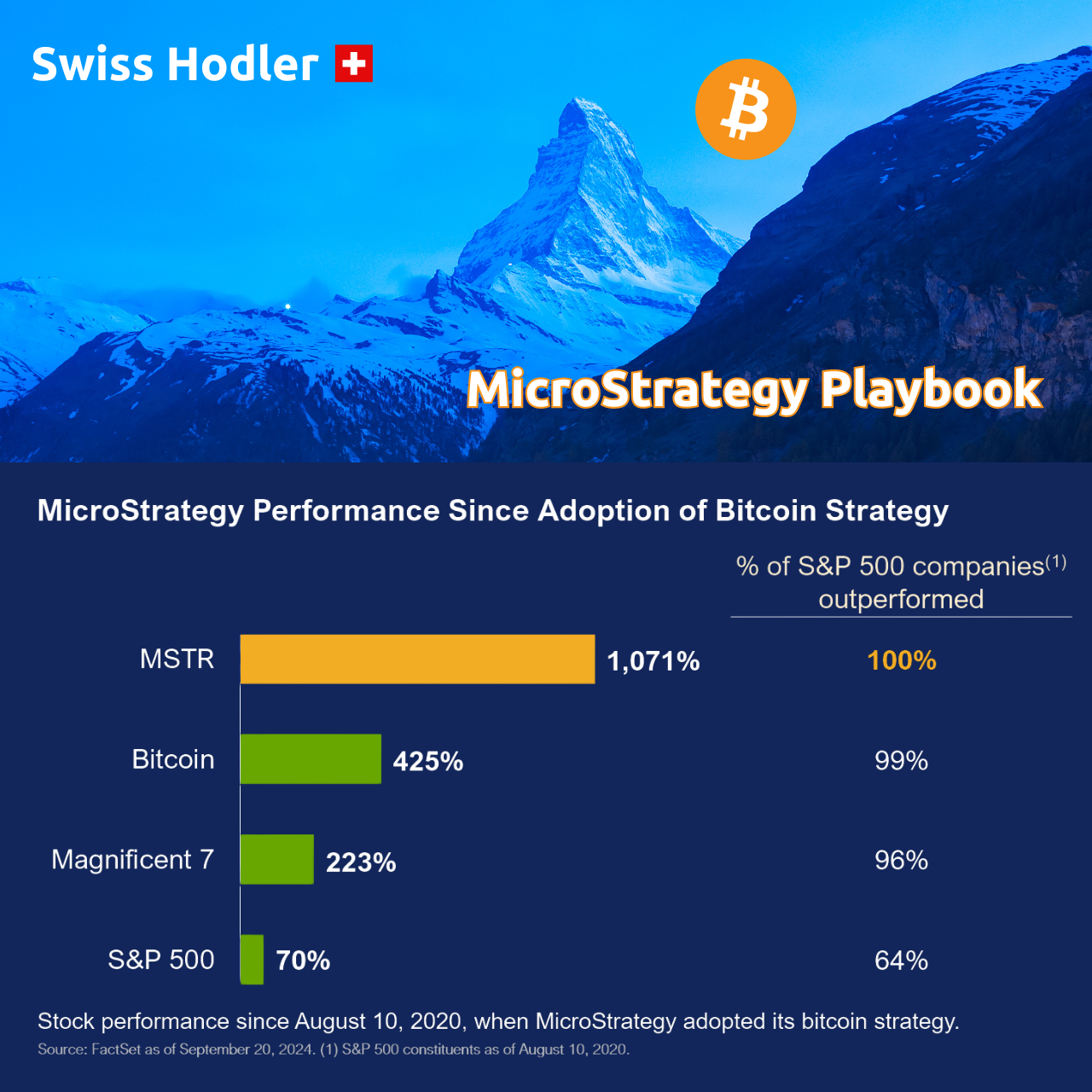

MicroStrategy: Die Bitcoin-Strategie als Vorbild

MicroStrategy (MSTR) unter der Führung von Michael Saylor ist ein herausragendes Beispiel dafür, wie Bitcoin die finanzielle Landschaft eines Unternehmens verändern kann. Durch die Umwandlung seiner Bargeldreserven in Bitcoin hat MicroStrategy sowohl den S&P 500 als auch seine eigenen Geschäftskennzahlen übertroffen:

Aktienentwicklung: Der Aktienkurs stieg von rund 120 USD auf über 500 % während des Bitcoin-Bullenmarktes.

Werterhalt: Die Strategie dient nicht nur der Spekulation, sondern dem Werterhalt in einem inflationsgeplagten Umfeld.

Bargeldreserven als totes Gewicht: In einem inflationären Umfeld verlieren Bargeldreserven jährlich an Wert. Bitcoin bietet eine Möglichkeit, diese Reserven gewinnbringend einzusetzen:

Kaufkraft-Erhalt: Dank der fixen Menge von 21 Millionen Coins bleibt Bitcoin resistent gegen Inflation.

Finanzielle Resilienz: Unternehmen mit Bitcoin-Reserven sind besser gerüstet, wirtschaftliche Stürme zu überstehen.

Talente anziehen: Bitcoin-Savvy-Talente bevorzugen innovative Unternehmen mit zukunftsweisenden Strategien.

Liquidität und Flexibilität: Bitcoins Markt ist global zugänglich und operiert rund um die Uhr.

Bitcoin vs. Zombie-Unternehmen

Zombie-Unternehmen kämpfen mit Schulden und stagnierendem Wachstum. Bitcoin kann diesen Kreislauf durchbrechen, indem es als höher rentierender Vermögenswert Flexibilität und Stärke in die Bilanz einbringt.

Schlüsselstatistiken:

Maximales Angebot: 21 Millionen Coins sorgen für eingebaute Knappheit.

Institutionelles Interesse: Immer mehr Großunternehmen erkennen Bitcoins Potenzial.

Hedge gegen den S&P 500: Bitcoin übertraf in den letzten zehn Jahren regelmäßig die Renditen des S&P 500.

Vorbereitung auf einen neuen Standard

Bitcoin auf der Bilanz ist mehr als ein Trend – es ist der Weg zu Widerstandsfähigkeit, Dezentralisierung und proaktivem Finanzmanagement. Unternehmen, die jetzt handeln, sichern sich einen Wettbewerbsvorteil und sind bereit für die Zukunft des globalen Finanzwesens.

Fazit: Bitcoin bietet Unternehmen die Energie, Flexibilität und das Wachstumspotenzial, um Stagnation zu entkommen und ihre Finanzen zukunftssicher zu gestalten. Es ist Zeit, Bitcoin nicht nur als Absicherung, sondern als wesentlichen Bestandteil einer klugen Unternehmensstrategie zu betrachten.

Relai Business richtet sich an kleine und mittelständische Unternehmen, die Bitcoin in ihre Bilanz aufnehmen möchten – mit exklusivem persönlichem Service und fachkundiger Beratung.

Tags: Bitcoin, Growth, Bitcoin Standard

Bitcoin 101: Verstehe Bitcoin, wie es funktioniert und warum jeder diese digitale Währung für finanzielle Freiheit kennen sollte

Bitcoin sorgt seit Jahren für Schlagzeilen, aber für Einsteiger kann es komplex wirken. Im Kern ist Bitcoin digitales Geld, das es Menschen ermöglicht, Zahlungen ohne Bank oder Mittelsmann zu senden und zu empfangen. Lass uns erklären, was Bitcoin ist, wie es funktioniert und warum es sich lohnt, mehr darüber zu erfahren.

Bitcoin ist eine dezentrale digitale Währung, die 2009 von einer unbekannten Person oder Gruppe unter dem Pseudonym Satoshi Nakamoto geschaffen wurde. Anders als traditionelle Währungen wie Dollar oder Euro wird Bitcoin nicht von einer Regierung oder Zentralbank kontrolliert. Stattdessen läuft es über ein Peer-to-Peer-Netzwerk, sodass Transaktionen direkt zwischen den Nutzern stattfinden.

Bitcoin, NICHT cRyPt0

Anfänger neigen dazu, Bitcoin mit anderen digitalen Assets oder "Kryptowährungen" in einen Topf zu werfen. Aber hier ist die Wahrheit: Bitcoin steht für sich.

Bitcoin ist nicht einfach nur ein weiteres "Krypto-Projekt" – es ist das Original und bleibt in seiner Mission und Struktur einzigartig. Anders als Tausende von Alternativ-Coins (sogenannte "Altcoins") wurde Bitcoin mit einem klaren Ziel geschaffen: Dezentralisiertes, sicheres Geld zu sein, das von keiner Regierung oder Firma kontrolliert oder inflationiert werden kann.

🔗 Dezentralisierung: Das Bitcoin-Netzwerk wird von einer globalen Gemeinschaft von Nodes und Minern unterstützt. Dadurch ist es resistent gegen Zensur, Manipulation und Kontrolle durch einzelne Parteien. Viele andere Kryptowährungen behaupten zwar, dezentral zu sein, haben aber zentrale Teams oder Stiftungen, die das Protokoll nach Belieben ändern können.

💎 Knappheit: Es wird nur 21 Millionen Bitcoin geben – nicht mehr, nicht weniger. Diese festgelegte Knappheit schützt Bitcoin vor Inflation. Andere Kryptowährungen haben oft keine so strikte Angebotsgrenze und können nach Belieben "gedruckt" werden.

🔒 Sicherheit und Stabilität: Bitcoin verfügt über das sicherste Netzwerk mit der längsten und bewährtesten Historie. Seit dem Start 2009 hat es sich als äußerst widerstandsfähig erwiesen. Andere Projekte mögen innovativ sein, erreichen aber nicht das gleiche Sicherheitsniveau – viele kommen und gehen.

🌍 Mission: Bitcoin soll als globale, dezentrale Währung und Wertaufbewahrungsmittel dienen – eine Alternative zu traditionellen Fiat-Währungen. Viele andere Krypto-Projekte verfolgen hingegen spekulative Ziele wie Smart-Contract-Plattformen, Gaming oder DeFi. Diese mögen zwar interessant sein, verfolgen aber nicht die gleiche Mission wie Bitcoin.

📌 Fazit: Zu verstehen, dass Bitcoin etwas anderes als "Krypto" ist, hilft dir, dich auf das Hauptziel zu konzentrieren: finanzielle Freiheit und Schutz vor Inflation. Bitcoin ist eine Bewegung, kein spekulativer Trend. Es ist solides Geld für langfristige Stabilität – und es ist gekommen, um zu bleiben.

Bitcoin läuft auf der sogenannten Blockchain-Technologie – einem öffentlichen Ledger, das jede Transaktion aufzeichnet. Hier ist, wie es funktioniert:

📖 Blockchain: Stell es dir als digitales Buch vor, das jede Bitcoin-Transaktion aufzeichnet. Dieses Ledger ist sicher, transparent und für jeden einsehbar.

⛏️ Mining: Neue Bitcoins werden durch das Mining geschaffen. Dabei lösen leistungsstarke Computer komplexe mathematische Probleme, um einen neuen "Block" von Transaktionen zur Blockchain hinzuzufügen. Als Belohnung erhalten Miner Bitcoin – was das Netzwerk sicher hält.

💼 Wallets: Um Bitcoin zu nutzen, benötigst du eine digitale Wallet. Eine Wallet ist wie ein Online-Bankkonto, in dem du Bitcoin speichern, senden und empfangen kannst. Jede Wallet hat eine eindeutige Adresse, ähnlich einer E-Mail-Adresse, die du teilen kannst, um Zahlungen zu empfangen.

💡 1. Finanzielle Unabhängigkeit:

Mit Bitcoin kannst du deine eigene Bank sein. Du kannst Geld senden und empfangen, ohne auf eine traditionelle Bank oder Dritte angewiesen zu sein. Volle Kontrolle über dein Geld – das bedeutet Freiheit.

💎 2. Begrenztes Angebot:

Im Gegensatz zu Fiat-Geld, das Regierungen unbegrenzt drucken können, ist die Anzahl der Bitcoins auf 21 Millionen begrenzt. Diese Knappheit schützt vor Inflation.

🌐 3. Global und zugänglich:

Bitcoin kann weltweit genutzt werden. Du brauchst kein Bankkonto – nur eine Internetverbindung und eine Wallet. Besonders nützlich für Menschen ohne Zugang zu Banken oder stabilen Währungen.

🕵️ 4. Privatsphäre und Sicherheit:

Bitcoin-Transaktionen benötigen keine persönlichen Daten, was die Privatsphäre erhöht. Zudem sorgt die Transparenz der Blockchain für Sicherheit und schützt vor Betrug.

📈 5. Investitionspotenzial:

Viele sehen Bitcoin als "digitales Gold". Aufgrund des begrenzten Angebots und der weltweiten Nachfrage hat Bitcoin das Potenzial, langfristig im Wert zu steigen.

📚 Lesen & Recherchieren:

Es gibt viele einsteigerfreundliche Ressourcen, darunter Bücher wie Der Bitcoin Standard von Saifedean Ammous.

💬 Communities beitreten:

Foren wie Reddit, X (ehemals Twitter) und Bitcoin-Meetups bieten hilfreiche Infos. Folge mir gerne auf X, LinkedIn, oder Instagram.

Du musst keinen ganzen Bitcoin kaufen. Schon mit kleinen Beträgen kannst du den Umgang mit Bitcoin erlernen.

👉 Zum Beispiel mit der, Relai app, wo du ab nur 50 EUR/CHF starten kannst.

🔥 Exklusiv: Null Gebühren auf deinen ersten 100 CHF/EUR-Kauf pro Monat – bis zu 1.200 CHF/EUR im Jahr!

Wenn du meinen Code SWISSHODLER benutzt, werden deine Gebühren um 10% reduziert!

Bitcoin mag anfangs kompliziert wirken, aber im Kern ist es einfach: digitales Geld, das dezentral, sicher und zugänglich ist.

In einer zunehmend digitalen Welt bietet Bitcoin eine neue Perspektive auf Geld, Unabhängigkeit und finanzielle Freiheit. Ob du neugierig oder skeptisch bist – Bitcoin zu verstehen, hilft dir, die Zukunft der Finanzen besser zu begreifen.

💬 P.S.: Du kannst auch eine persönliche Bitcoin-Education-Session Bitcoin Education-Session mit mir buchen!

Tags: Bitcoin, Bitcoin Standard

Introduction:

In a recent fireside chat hosted by Bernstein, Michael Saylor, co-founder and Executive Chairman of MicroStrategy, discussed his Bitcoin investment thesis and how his company transformed by adopting Bitcoin as its primary treasury reserve asset. Moderated by Gautam Chhugani of Bernstein, the conversation covered the rationale behind MicroStrategy's bold Bitcoin strategy, its impact on the company, and the broader implications for investors and businesses.

MicroStrategy’s Journey to Bitcoin:

Founded in 1989, MicroStrategy was a low-growth enterprise software company by 2020, with stagnant business prospects and $500 million in cash. Faced with the choice of risky acquisitions, share buybacks, or holding cash with 0% interest, Saylor opted to take a risk on Bitcoin. He viewed Bitcoin as a transformational monetary network, likening it to investing in tech giants like Google or Amazon before mainstream recognition. Since adopting Bitcoin, MicroStrategy has built one of the largest Bitcoin balance sheets, positioning itself as a pioneer in digital capital strategy.

Bitcoin as the Superior Asset:

Saylor described Bitcoin as "digital gold," perfect money, and a unique diversifier that outperforms all other asset classes. With a compound annual growth rate (CAGR) of 49% over the past four years, Bitcoin has consistently outperformed traditional investments, including the S&P 500, real estate, and gold. He emphasized that Bitcoin is a 1,000-year asset, capable of preserving value without counterparty risks associated with physical and financial assets. Unlike traditional capital, Bitcoin is durable, scarce, and immune to inflationary pressures, making it the ultimate store of value.

The Investor Dilemma:

Most returns in the S&P 500 come from a small number of tech monopolies. Traditional portfolios are struggling to keep up with inflation rates, and conventional investments are not delivering desired returns. Saylor posits that Bitcoin offers a solution to this investor dilemma, providing superior performance in both the short and long term. MicroStrategy’s approach has been to leverage this by buying Bitcoin, securing cheap capital, and transforming it into high-yield digital assets.

MicroStrategy's Arbitrage Strategy:

MicroStrategy has raised over $10 billion to acquire Bitcoin, achieving significant returns through smart capital structuring. By borrowing at low interest rates and investing in Bitcoin, the company has capitalized on arbitrage opportunities, outperforming all 500 companies in the S&P 500. Their strategy involves issuing convertible debt, equity, and other financial instruments backed by Bitcoin, allowing them to outperform the market while minimizing downside risks.

Volatility as a Feature, Not a Bug:

Addressing the concern of Bitcoin's volatility, Saylor explained that volatility is not a flaw but a feature that attracts traders, investors, and financiers seeking better returns. Volatility provides the liquidity and opportunities for financial products like derivatives, which help generate superior yields and improve the capital structure of companies that adopt Bitcoin. According to Saylor, the risks associated with Bitcoin are outweighed by its potential as a powerful deflationary asset.

The Future of Bitcoin Adoption:

The chat concluded with insights into the future of Bitcoin as an asset class. Saylor believes that institutional adoption is accelerating, driven by the launch of Bitcoin ETFs, regulatory acceptance, and Bitcoin's integration with traditional finance. As more companies adopt Bitcoin as a treasury reserve asset, demand will drive prices higher, making Bitcoin a necessary part of any long-term investment strategy.

Key Takeaways:

Michael Saylor's discussion reveals that Bitcoin is more than just an asset—it's a revolutionary financial technology that transforms how businesses think about capital preservation and growth. With its unique qualities as digital property, Bitcoin offers a sustainable way for companies to protect and grow their wealth in a world of increasing financial uncertainty. MicroStrategy's strategy serves as a blueprint for leveraging Bitcoin to create long-term value in the digital age.

Ready for a Bitcoin Standard?

Relai Business is for small to medium-sized businesses who want to add Bitcoin to their balance sheets with exclusive personal service and expert guidance.

.webp?width=1200&height=675&name=michael-saylor-sees-bitcoin-surging-to-13-million-by-2045%20(1).webp)

Tags: Bitcoin, Growth, Bitcoin Standard, Bitcoin Strategy for Businesses, MicroStrategy Playbook

Bitcoin has been making headlines for years, but for those just getting started, it can seem complex. At its core, Bitcoin is digital money that allows people to send and receive payments without a bank or middleman. Let’s break down what Bitcoin is, how it works, and why it’s worth knowing about.

Bitcoin is a decentralized digital currency created in 2009 by an unknown person or group using the pseudonym Satoshi Nakamoto. Unlike traditional currencies like the dollar or euro, Bitcoin isn’t controlled by any government or central bank. Instead, it operates on a peer-to-peer network, meaning transactions happen directly between users.

Bitcoin, NOT cRyPt0

It’s easy for beginners to group Bitcoin with other digital assets or “cryptocurrencies,” but here’s the truth: Bitcoin stands apart. Bitcoin isn’t just another “crypto”—it’s the original and remains unique in both its purpose and structure. Unlike thousands of alternative coins (often called “altcoins”), Bitcoin was created with a clear mission: to be decentralized, sound money that can’t be controlled or inflated by any government or corporation.

Decentralization: Bitcoin’s network is supported by a global community of nodes and miners, making it resistant to censorship, manipulation, and control by any single entity. Many other cryptocurrencies claim decentralization but often have central teams or foundations that can influence or change the protocol at will.

Scarcity: Bitcoin has a fixed supply of 21 million coins—no more, no less. This built-in scarcity means Bitcoin’s value isn’t eroded by inflation. Other cryptocurrencies, on the other hand, often don’t have such strict supply limits and can be inflated at will.

Security and Stability: Bitcoin has the most secure network, with the longest and most proven history. Launched in 2009, it has been battle-tested and has proven to be incredibly resilient. Other projects, while innovative, lack the same level of security, and many have come and gone.

Mission: Bitcoin’s goal is to serve as a global, decentralized currency and store of value—an alternative to traditional fiat currencies. Many other crypto projects focus on different, often speculative goals like building platforms for smart contracts, gaming, or decentralized finance (DeFi), which may be valuable but aren’t aimed at the same mission as Bitcoin.

Understanding that Bitcoin is different from “crypto” will help you focus on its primary goal: offering financial freedom and a hedge against inflation. Bitcoin is a movement, not a speculative token or trend. It’s sound money for anyone looking for long-term stability, and it’s here to stay.

Bitcoin runs on a technology called blockchain, which is like a public ledger that records every transaction. Here’s how it works:

Bitcoin offers several advantages that make it valuable to understand, even if you’re not planning to buy or use it right away.

Bitcoin lets you be your own bank. You can send and receive money without the need for a traditional bank or approval from a third party. This means you have complete control over your money, which can be empowering.

Unlike traditional money, which governments can print in unlimited quantities, Bitcoin has a fixed supply of 21 million coins. This scarcity makes it more resistant to inflation, as the value of Bitcoin isn't easily diluted by "printing" more of it.

Bitcoin is global, meaning it can be used anywhere in the world. You don’t need a bank account to use Bitcoin—just an internet connection and a digital wallet. This can be especially useful for people in areas with limited access to banks or stable currencies.

Bitcoin transactions don’t require personal information, which can enhance privacy. Plus, the Bitcoin blockchain’s transparency and decentralized nature make Bitcoin transactions secure and resistant to fraud.

Many people see Bitcoin as “digital gold” and invest in it as a way to protect their wealth over time. Because of its limited supply (there will only ever be 21 million bitcoins) and global demand, Bitcoin has the potential to increase in value over time.

For example, Relai app allows you to start with as little as 50 EUR/CHF!

There are also zero fees on your first 100 CHF/EUR purchase each month - up to 1,200 CHF/EUR a year!

Bitcoin might seem complex at first, but it’s simply digital money designed to be decentralized, secure, and accessible. As our world becomes more digital, Bitcoin offers a new way to think about money, independence, and financial freedom. Whether you’re curious or skeptical, learning about Bitcoin can help you better understand the future of finance.

p.s. You can also book a one-on-one Bitcoin Education session with me.

Tags: Bitcoin, Bitcoin Standard

In a world where inflation is chipping away at cash reserves and economic uncertainty is the norm, holding Bitcoin on a company balance sheet is more than just a hedge—it’s a game-changer. Far from being a “speculative asset,” Bitcoin has shown resilience, impressive returns, and a unique value proposition that many companies are still slow to embrace. Let’s break down why every company should hold Bitcoin on its balance sheet and how this can be a lifeline to unzombify any business, giving it fresh energy, growth potential, and future-proof financial strength.

Bitcoin has consistently outperformed traditional assets, including major indexes like the S&P 500. Here’s a quick look at Bitcoin’s performance compared to the S&P 500 over recent years:

MicroStrategy (MSTR), under the leadership of Michael Saylor, is perhaps the most notable example of how Bitcoin can transform a company’s financial landscape. By converting its cash reserves to Bitcoin, MicroStrategy has outperformed the S&P 500 and even its own business metrics, largely due to Bitcoin's appreciation.

Since beginning its Bitcoin acquisitions in August 2020, MicroStrategy’s stock has skyrocketed:

Corporate cash reserves sitting idly on a balance sheet are dead weight, especially in an inflationary environment where cash loses value every year. Holding Bitcoin allows a company to put its reserves to work, giving businesses a new way to grow assets.

Preservation of Purchasing Power: With fiat currencies losing purchasing power through inflation, Bitcoin acts as a hedge. Unlike cash, Bitcoin’s fixed supply and scarcity help it hold value and resist inflation.

Financial Resilience: During economic downturns, companies with Bitcoin reserves are better positioned to weather financial storms. By securing a portion of assets in Bitcoin, businesses can diversify risk and have a reliable store of value.

Attracting Modern Talent: More employees, especially in the tech sector, are Bitcoin-savvy and prefer working for forward-thinking companies. Holding Bitcoin on the balance sheet signals innovation and commitment to future-proofing—a quality that resonates with top talent.

Liquidity and Flexibility: Bitcoin’s market is globally accessible and operates 24/7. Unlike other assets that may require banks and intermediaries to liquidate, Bitcoin provides instant liquidity, offering companies unprecedented financial flexibility.

“Zombie companies” refer to businesses that are barely scraping by, weighed down by debt and stagnant growth. These companies are often unable to keep up with inflation and are locked in a cycle of low profitability. Bitcoin’s value growth has the power to “unzombify” these businesses by injecting a higher-yield asset into their portfolios and potentially increasing their balance sheet’s strength and flexibility. Companies that adopt Bitcoin can transition from a survival-focused model to one primed for growth and long-term viability.

Bitcoin on the balance sheet is more than a trend; it’s a shift toward a new corporate standard that values resilience, decentralization, and proactive financial management. Companies that act now stand to gain the competitive edge as the world transitions toward digital and decentralized finance. Those who don’t risk being left behind, stuck in old financial paradigms.

To thrive in a changing economy, companies need more than traditional assets and cash reserves. Bitcoin is the tool that will give businesses the energy, flexibility, and growth potential they need to escape stagnation, future-proof their finances, and join the revolution in global finance. It’s time to consider Bitcoin—not just as a hedge, but as a core part of a smart, forward-thinking corporate strategy.

Relai Business is for small to medium-sized businesses who want to add Bitcoin to their balance sheets with exclusive personal service and expert guidance.

Tags: Bitcoin, Growth, Bitcoin Standard

The Belle Époque was the real deal - back when people were actually building stuff that mattered. Real art, real engineering, real progress. Why? Because they had hard money backing it up. Gold was the standard, and when your money has value, you can actually plan, invest, and build for the future. Fast forward to today? Fiat has turned everything into a joke.

The Belle Époque worked because gold kept everything honest. No money printers, no central banks inflating your savings into dust. When you’ve got a sound base, people start stacking, investing, and building. You had bridges, railroads, electrification - stuff that actually pushed society forward. It wasn’t fueled by debt or manipulated markets; it was fueled by real capital.

Now look at this fiat clown world. The money’s fake, the economy’s fake, and everything’s just built on debt and bubbles. Central banks print, governments spend, and your hard-earned cash is worth less every year. They’ve rigged the game, and they want you to play along like everything’s fine. Spoiler: it’s not.

Fiat is a parasite, plain and simple. It’s designed to rob you, to inflate away your work while the people at the top get richer off the backs of everyone else. They control the money, they control the system, and they keep you on the hamster wheel, grinding for scraps while they rig the economy to keep themselves in power. Boom, bust, print, repeat - it’s all a scam.

What did we get out of it? Instead of real progress, we get stock market casinos, housing bubbles, and a culture of consumption. Art and ideas? Forget about it. Everything’s disposable. When your money’s a lie, your society starts looking like one too.

Enter Bitcoin - hard money that these parasites can’t print into oblivion. It’s the tool to break the fiat chains and build a new era that isn’t controlled by central banks and governments. With Bitcoin, there’s no inflation eating away at your savings, no manipulation, no funny business. You stack sats, you save, and you plan for the long term - just like it was during the real Belle Époque.

The fiat overlords hate it because it’s a threat to their game. Bitcoin exposes their scam and offers a way out. That’s why they fight it, ban it, and spread FUD. They know it’s a lifeboat, and they want to keep you drowning in their debt cycle.

The fiat system is done. It’s time for a reset, and that means building a new Belle Époque, powered by Bitcoin. Sound money lets people create, invest, and thrive. It’s how we get back to real progress - stuff that lasts.

Don’t fall for their fiat lies. Stack sats, opt out, and start building for a future where hard money rules and the parasites get left in the dust.

Tags: Bitcoin, Bitcoin Standard